nh meals tax rate

SB 343 would establish a committee to study room occupancy tax revenues and fees and the formula for distribution to municipalities. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

New Hampshire Sales Tax Rate 2022

2021 Tax Rate Breakdown Applications for Abatement of 2021 Taxes will be accepted until March 1 2022 Applications for Exemptions or Credits for 2022 must be filed by April 15 2022.

. Other taxes in New Hampshire include a cigarette tax a gas tax and an excise tax on beer. Suggestions for new or improved meals will be sought as well as feedback on service and. NH HOTEL GROUP SA Tax ID no.

Hotels seasonal home rentals campsites restaurants and vehicle rental agencies are required to register with and obtain a license from the Department of. Technical Review Meeting Materials. The tax rate will drop by 3 mills but bills for many property owners still will rise because of revaluation.

Tax Rate Calculation Data. New Hampshire School Administrative Unit 16 SAU 16 Stratham School List. Friday - 8 am - 1230 pm.

The NH Madrid Nacional hotel has a central spot on one of Madrids most prestigious avenues the Paseo del Prado. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. NH HOTEL GROUP SA Tax ID no.

Calle Santa Engracia 120 7ª 28003 - Madrid More info. Tues Wed Thurs - 830 am - 4 pm. Are done with your session you may log off to visit other Towns around the State to compare our tax rate.

Tax is 500 or greater. Federal government websites often end in gov or mil. New Hampshire Property Tax.

Book your room in NH Budapest City a luxurious 4-star hotel perfect for business trips in the Hungarian capital Budapest. Filing options - Granite Tax Connect. Meals Rooms and Rentals Tax RSA 78-A.

NHs Meals and Rooms Tax revenues are currently shared per capita rather than basing the formula on a. See the button below. As both accomplished tax professionals and Certified Financial Planners EagleStone offers clients an integrated total financial solution that includes tax preparation and planning wealth advisory asset protection retirement benefits administration.

The gov means its official. 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. Town of Stratham 10 Bunker Hill Avenue Stratham NH 03885 603 772-4741.

The rent is 600 a month with a five-year lease available. If anyone in Groton is interested in receiving Home delivered meals Meals on Wheels 2-3. Meals and Rooms Operators.

Serving meals throughout the day. Before sharing sensitive information make sure youre on a federal government site. While New Hampshire.

GIS Maps Town Tax MapsTown Road Map. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration.

Understanding Your Tax Rate. The Meals and Rentals Tax is a tax imposed at a rate of 9 on taxable meals occupancies and rentals of vehicles. Please contact the Tax Collector if you have any questions about this process.

The New Haven Board of Alders approved the 63317 million fiscal 2022-23 budget. Calle Santa Engracia 120 7ª 28003 - Madrid More info. Homeowners pay an average effective property tax rate of 205 the fourth-highest rate in the US.

Monday - 830 am-7 pm. Our guests really rate the breakfast a tantalizing buffet of cheeses cold meats pastries and more. Its in the Art Triangle home to 3 world-famous art museums.

This includes the two state taxes on business taxes on hotel room rentals and restaurant meals real estate transfers tobacco communication services and. Please visit the New Hampshire Tax Kiosk. The Moose Mountain Café will be located at 200 Main Street Moose Mountain NH with seating for 20 patrons.

Counter CPA will prepare tax returns and quarterly payroll and tax. And tax considerations must be taken into account when considering investment strategies. 1 of 5.

Tax Rate Calculation Data. The increase in the Feds key rate raised it to a range of 075 to 1 the highest point since the pandemic struck in March of 2020.

New Hampshire Sales Tax Rate 2022

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Perceptual At Product Category Level Perceptual Map Interesting Questions Alcohol Mixers

New Hampshire Meals And Rooms Tax Rate Cut Begins

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Massachusetts Sales Tax Small Business Guide Truic

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

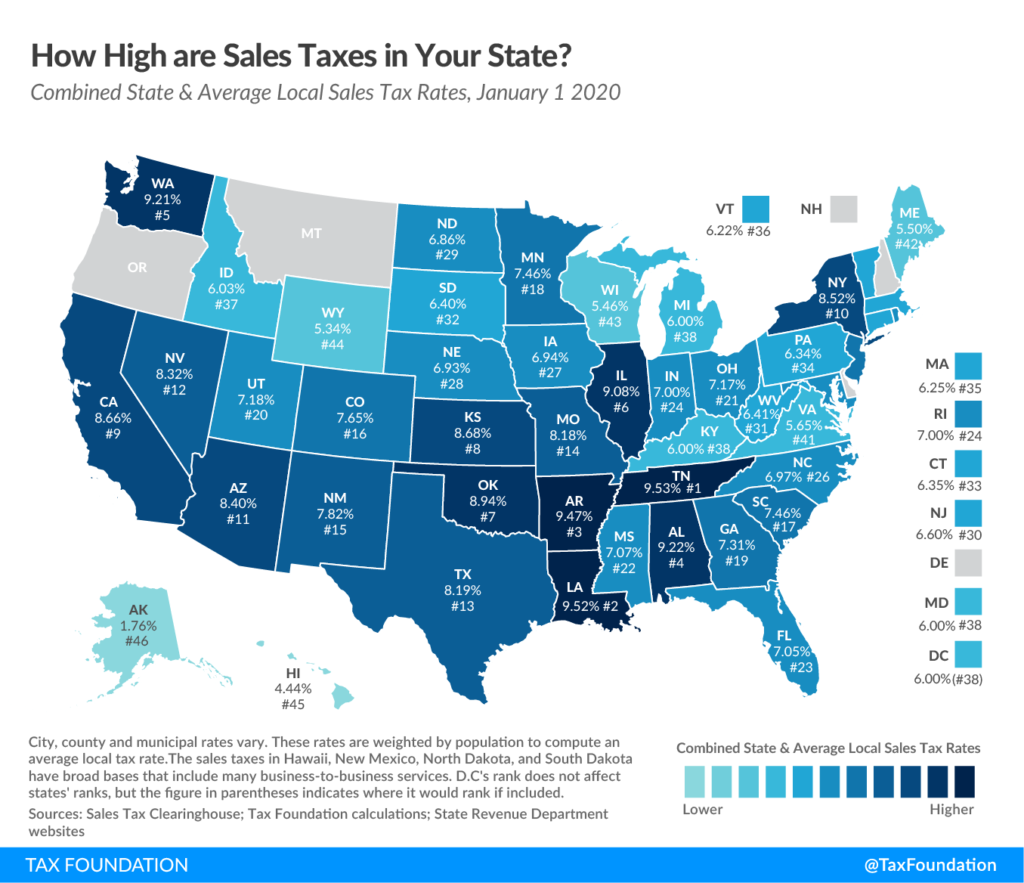

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Taxes In The United States Wikiwand

Utah S Recent Sales Tax Reform Efforts And Sales Taxes Across The Nation Utah Taxpayers

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax Money Choices

Monday Map Sales Tax Exemptions For Groceries Tax Foundation